Offering a 401(k) retirement plan for your practice in which your employees can participate is a valuable benefit. Frequently, motivating your employees to appreciate and take advantage of this benefit can be a challenge. However, a retirement plan with engaged, informed and participating employees is a successful retirement plan.

Two of the factors most often mentioned when measuring a successful 401(k) plan are high participation rate (80%-90% of eligible employees participating) and high contribution rates. With uncertainty surrounding the future of Social Security, rising healthcare costs, and increased life expectancy, the ability to achieve a fulfilling retirement is heavily dependent on the amount of funding that a participant can accrue in his/her retirement plan. It is vital for employees to take advantage of the opportunity you offer them by participating in your firm’s 401(k) plan.

Most plan providers offer tools and calculators available on a website to assist participants in determining how much they need to save in order to meet their retirement goals. In addition, encouraging employees to visit the site to monitor their accounts and take advantage of the educational tools may get them more engaged in managing their own retirement savings and making your plan more successful.

Benefits of Increased Savings

There are generally two high-level strategies to follow to generate a retirement plan account balance that meets retirement goals: start early and increase savings over time. All new employees should be encouraged to start as soon as they are eligible, at a savings rate with which they are comfortable and which should be re-evaluated annually, if not more frequently, to verify that they are on course to meet their retirement savings goals. If they are not on track, they should consider increasing their contribution rates.

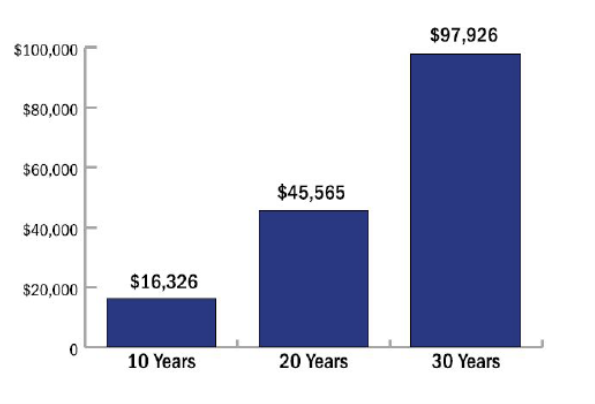

The hypothetical chart below assumes 6% rate of return and shows the potential an employee could generate by increasing his/her 401(k) contribution by a small amount each week. All participants should be strongly encouraged to invest in line with their risk tolerance levels, since investments are subject to market risk, will fluctuate, or may lose value.

Encouraging your employees to start early and increase their savings rates over time can help your plan be successful for both them and you.

Regardless of when you plan to retire, most practice owners understand that sponsoring a retirement savings plan can help attract and retain qualified employees. The ultimate success of a plan depends in large part on having engaged, informed, and participating employees.

The AIA Trust is here to help

The AIA Trust endorses retirement savings and distribution plan products through Equitable Financial that can assist you toward achieving your retirement goals. With over 50 years of experience working with AIA members, Equitable Financial Retirement Program Specialists are licensed to provide the knowledge and resources to assist you and your team evaluate the plan options most suited for your personal retirement goals. In addition, Equitable Financial provides a full range of recordkeeping and plan administration services to complement its suite of retirement product offerings for AIA members and employees. For additional information on these AIA-endorsed member benefits, please call Equitable Financial at 1-800-523-1125 or visit at mrp.equitable.com/ps/partners/partner-aia.cfm

* This reference applies exclusively to Equitable Financial Life Insurance Company.

This article has been written for general information purposes only. This material does not constitute an offer or solicitation of any kind and is not intended, and should not be relied upon, as investment, tax, legal, or financial advice or services.

Retirement plans are issued by Equitable Financial Life Insurance Company (Equitable Financial)(NY, NY). Equitable Financial and its affiliates do not provide tax or legal advice. You should consult with your attorney and/or tax advisor before purchasing a contract.

Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company(Equitable Financial) (NY, NY), Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company with main administrative headquarters in Jersey City, NJ, and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN).

GE-3768738.1b (9/21)(Exp. 9/23)