Most architects and their employees are actively contributing to a retirement plan. Regardless of your personal situation, it makes sense to review the type of retirement plan that you have as well as your individual savings plan for retirement to make sure that you are maximizing your potential savings.

The type of retirement plan, investment choices, and contribution level depend greatly on one’s personal situation—such as business or employment structure, age, income, years until retirement, and other considerations—so all of these should be considered.

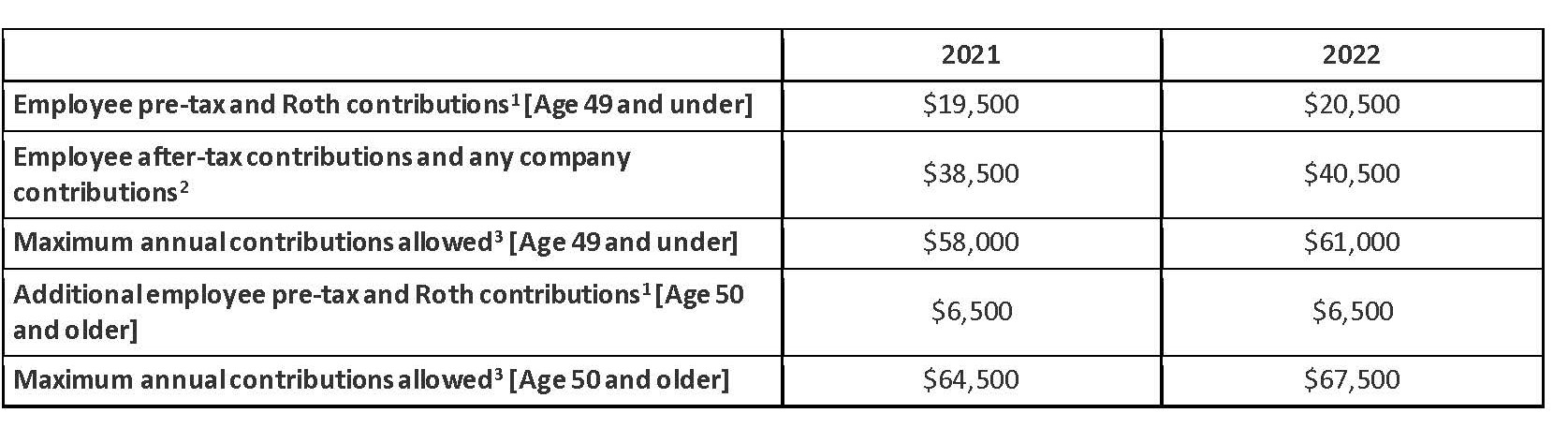

The IRS announces updates to contribution limits every year. The 2022 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and most 457 plans, as well as income limits for IRA contribution deductibility, are listed below.

Contribution limits for 401(k), 403(b), and most 457 plans

- If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

- Company contributions include any employer matching, profit-sharing, and non-elective contributions.

- Amount typically not to exceed the lesser 100% of your compensation or this number. Your retirement plan might limit the compensation to something less than 100%; please refer to your plan’s Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $305,000. You can make contributions up to the IRS contribution limits noted above up to $305,000.

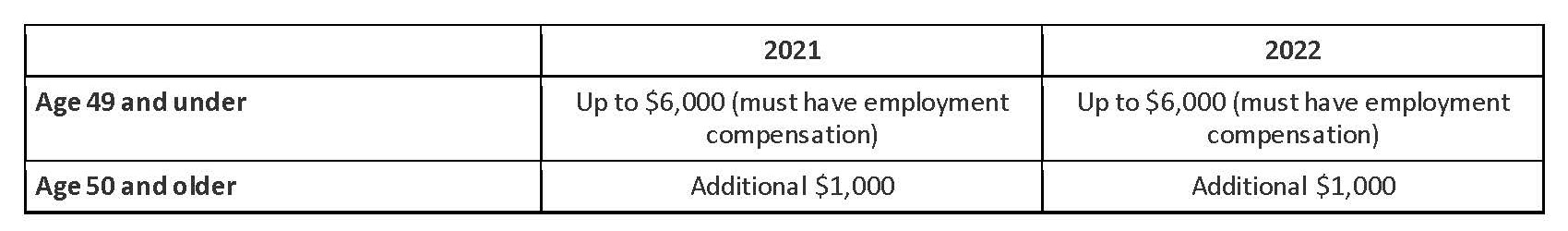

Roth IRA and Traditional IRA contribution limits

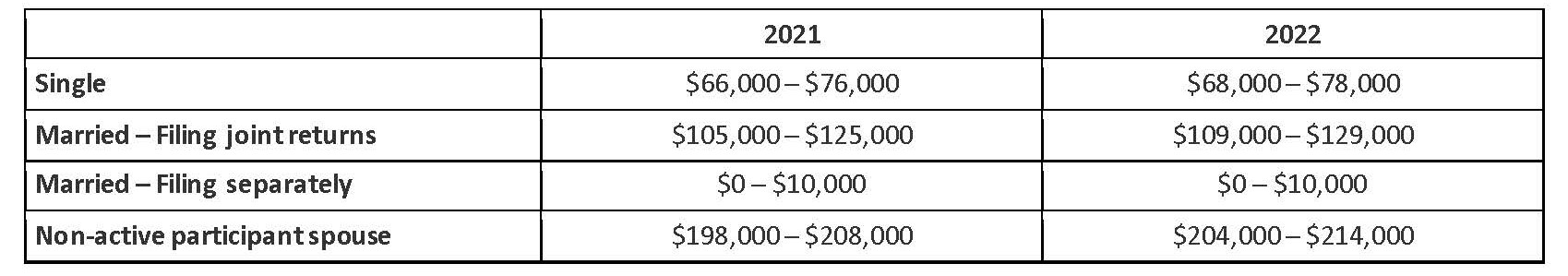

Traditional IRA modified adjusted gross income limit for partial deductibility

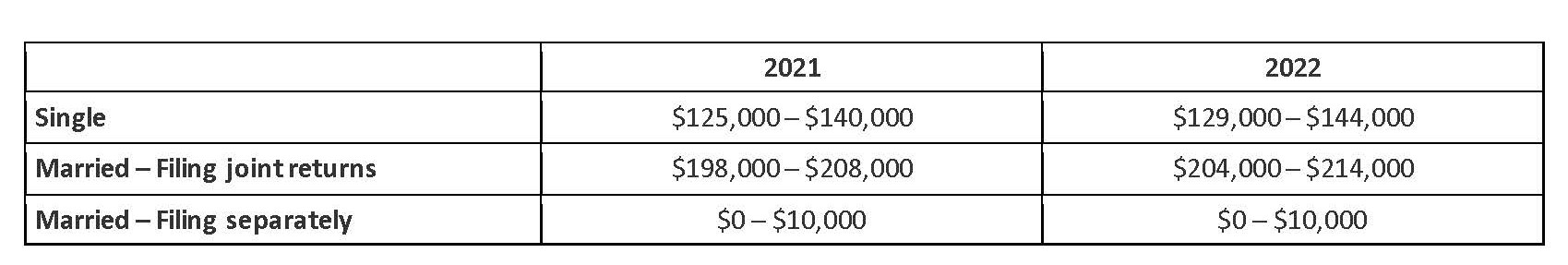

Roth IRA modified adjusted gross income phase-out ranges*

Roth IRA modified adjusted gross income phase-out ranges*

Note: As of 2010, there is no income limit for taxpayers who wish to convert a traditional IRA to a Roth IRA.

Make the most of your savings

If you are not saving to the max in your current plan, consider increasing your contribution in 2022 to the IRS limit of $20,500 to help you to reach your retirement savings goals.

You may wish to investigate other plan design types, such as Defined Benefit and Cash Balance plans, that can greatly increase your contribution opportunity depending on your personal situation.

The AIA Trust is here to help

The AIA Trust endorses retirement savings and distribution plan products through Equitable Financial that can assist you toward achieving your retirement goals. With over 50 years of experience working with AIA members, Equitable Financial Retirement Program Specialists are licensed to provide the knowledge and resources to assist you and your team evaluate the plan options most suited for your personal retirement goals. In addition, Equitable Financial provides a full range of recordkeeping and plan administration services to complement its suite of retirement product offerings for AIA members and employees. For additional information on these AIA-endorsed member benefits, please call Equitable Financial at (800) 523 1125 or visit at mrp.equitable.com/ps/partners/partner-aia.cfm

This article has been written for general information purposes only. This material does not constitute an offer or solicitation of any kind and is not intended, and should not be relied upon, as investment, tax, legal, or financial advice or services.

The Members Retirement Program is funded by a group variable annuity contract issued and distributed by Equitable Financial Life Insurance Company (Equitable Financial) NY, NY. Annuities have limitations and restrictions. For costs and complete details contact a Retirement Program Specialist. Equitable Financial and its affiliates do not provide tax or legal advice. You should consult with your attorney and/or tax advisor before purchasing a contract.

* This reference applies exclusively to Equitable Financial Life Insurance Company.

Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company(Equitable Financial) (NY, NY), Equitable Financial Life Insurance Company of America (Equitable America), an AZ stock company with main administrative headquarters in Jersey City, NJ, and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN).

GE-